Follow us on LinkedIn for all the latest insights, exciting updates and iFD news.

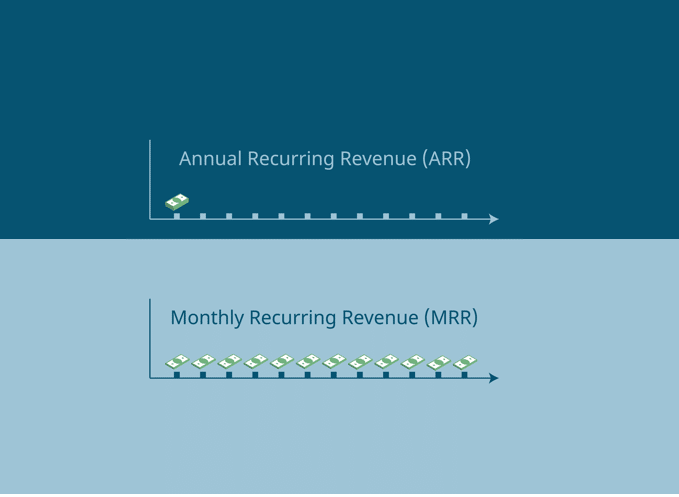

Subscription business models differ from traditional models and often require their own unique metrics. MRR (Monthly Recurring Revenue) is perhaps one of the most critical metrics for a SaaS business. ARR (Annual Recurring Revenue) is a related metric with several key differences.

While it sounds like ARR and MRR can be used interchangeably, the question remains: Which metric should a SaaS business use to measure growth?

In this blog, we dive deeper into ARR and MRR and consider the uses of each metric in the context of a SaaS business.

In this blog, we answer the following:

- What is MRR?

- Is MRR important for a SaaS business?

- What is ARR?

- Is ARR important for a SaaS business?

- What is the difference between ARR and MRR for SaaS businesses?

- Which metric is best for a SaaS business?

By their nature, subscription business models generate recurring revenue as customers pay to use their services. This recurring revenue can be measured monthly in the form of MRR or annually, known as ARR.

Though not Generally Accepted Accounting Principles (GAAP), ARR and MRR have become metrics for growth within SaaS businesses.

Monthly Recurring Revenue (MMR)

What is MRR?

MRR is the sum of all subscription revenue expressed as a monthly value. For most businesses, MRR is the sum of all new subscriptions and upgrades, minus downgrades and cancelled subscriptions. It’s the revenue equivalent used by every SaaS business. It is a normalised metric that indicates the average revenue a business can expect to earn in a month from paying subscribers.

Is MRR important for a SaaS business?

MRR is more appropriate for businesses whose customers sign monthly subscriptions. It is also a useful metric for early-stage companies as it helps them closely monitor revenue and make quick but informed changes to their operations to maximise growth.

Similarly, it is useful when it comes to:

- Identifying monthly trends: Since it provides monthly trends, a month is enough to assess a company’s performance.

- Robust financial forecasting and planning: The MRR is a predictor of monthly revenue, so businesses can use this metric to forecast expenditure and revenue and plan to estimate future cash flow.

- Business growth: MRR can be used to assess the growth rate of the business. For example, the business is doing well if the MRR is steadily rising. However, if it declines, leaders may need to take corrective action.

Annual Recurring Revenue (ARR)

What is ARR?

You may be asking yourself: “how much revenue will I be able to recognise in the next 12 months based on live contracts and users that I know?”.

Whereas MRR expresses subscription revenue as a monthly value, ARR, by contrast, is the sum of all subscription revenue expressed as an annual value. To calculate ARR, divide each customer’s total contract value by the number of years in their full contract. Sum the results to get your total revenue (in terms of ARR).

The ARR is popular with B2B companies that sell multi-year subscription plans to larger businesses.

However, the metric has several limitations, especially when valuations become very dependent on ARR and MRR and when valuation multiples of ARR and MRR are universally accepted. As a result, businesses must put more emphasis on how they define these two metrics.

Additionally, since there is no statutory definition of ARR and MRR in accounting standards, the KPI can be readily abused and exploited, which allows companies to manipulate the metric by including types of revenues that are not recurring.

Building on ARR, several other metrics have since spun out off the back of it. For example, businesses now compare the ARR with the cost to acquire a customer and, therefore, how much you should be spending on marketing to drive your ARR.

Is ARR important for a SaaS business?

The ARR metric is important for the following reasons:

- Assessing the financial health of the business: ARR shows whether total revenue is increasing or decreasing and the reasons why this may be happening. With these insights, finance leaders can focus on and improve specific areas to increase revenue.

- Budgeting: With the ARR, CEOs can better plan major investments. This includes, but is not limited to, spending on employee compensation, recruiting key hires, allocating more to sales and marketing, and purchasing or upgrading other fixed assets.

- Forecasting revenue: With ARR, businesses can forecast revenues and cash flow more accurately, which allows leaders to plan expenses more precisely.

- Attracting investors: Businesses with a good ARR attract investors and buyers. A strong ARR gives investors confidence in the current and future performance of the company.

What is the difference between ARR and MRR?

Whilst at a surface level, the differences between ARR and MRR may be few and far between, the difference between the two metrics lies in the finer details:

- ARR provides an overall view of a business, while MRR assesses elements of the business at a granular level.

- While MRR provides short-term insights, ARR assesses the success of your company in the long term.

- ARR is more suitable when subscribers sign multi-year deals, whereas MRR is more appropriate when customers sign monthly subscriptions.

Can you multiply the MRR by 12 to generate the ARR?

ARR gives a business a broader picture of financial health. It’s a mountain range to MRR’s individual peaks, creating its own unique insights.

Some businesses with short-term lengths multiply their MRR by 12 to generate their ARR. While this may seem logical, if your business experiences seasonal fluctuations, there may be a danger of overestimating the ARR figure by temporary subscription numbers. Additionally, because customers may not be contracted to remain with the business for a full year, this calculation may not accurately account for month-to-month churn.

Which metric is best for a SaaS business?

We recently ran a poll on LinkedIn to canvas opinion on which metric is best for a SaaS business. The results were compelling; 60% voted in favour of MRR, and 40% voted for ARR. If you missed the poll on LinkedIn, let us know your thoughts in the comments.

However, the short answer is it depends.

Every SaaS business is different and makes decisions based on these idiosyncrasies. Some companies operating in this space charge monthly rates and track short-term changes through MRR to inform immediate responses. On the other hand, smaller businesses may offer annual contracts with monthly usage-based pricing.

Both metrics can be useful to an extent, but which one a business chooses to select will depend on the individual business.

Author’s Biography

Written by Alex Hawkes, Fractional CFO). Over the past 7 years, Alex has helped a number of tech start-ups. She has secured over £40m in investment, reclaimed more than £1.5m in R&D tax credits and set up EMI option schemes.

(Image source: Shutterstock)